So you’ve begun seriously thinking about buying a home—you kind of figure it’s “time,” whatever that means. For many millennial home buyers right now, that means several things: the market is somewhat less frantic making it less intimidating, you have student loans under control, you’ve finally hit a stride in your work life, and you feel like you have a window of time with the possibility of rising interest rates looming.

You also like the sense of permanency home ownership entails; for years, you swore a more flexible lifestyle was for you, but now with a possible marriage and kids, the settling down thing has gotten more appealing. But you don’t know what you don’t know, and you still have concerns: that’s why Cleveland Home Title is here to put more spring in your step as you move forward and to give you useful tips that will help guide the process.

What advantages can you gain by buying a home? Here are three that are especially applicable to millennials:

Control rising housing costs

Once you have opened a mortgage, your monthly housing payment remains static, assuming you got a standard fixed rate mortgage (which we encourage). With rental costs that are climbing at alarming rates, you may be at risk for being priced out of your current rental situation at some point unless it is below your means. With a mortgage, your payment remains the same even as your wages climb.

Add to your net worth

If there’s anything the Great Recession taught millennials, it’s that you can’t look at your primary residence as an investment property. In the boom of the early 2000’s, many families over-leveraged themselves because they figured that the fantastic housing market would carry them further toward their financial goals. That being said, if you are careful about how much you borrow, you can still view your home as a piece of your overall net worth. You may not make money on it per se when counting inflation and a future sale, but you will get to keep a large portion of the hard-earned cash you would have been dumping into rent. That’s a big deal.

Help your kids get good grades

What?! No, seriously. Studies over the past twenty years have confirmed that children who grow up in households where the parents or parent owns the home actually get better grades than their peers and are more likely to go to college. How does that work? Social scientists believe that the stability and rootedness in a community increase a child’s likelihood of being able to concentrate in school, get homework done, and have a greater sense of wellbeing. It also boosts their self-esteem. While this doesn’t have to be absolute for every family in America, it is definitely worth thinking about.

There are many more benefits to homeownership, but those are three that we find really resonate with millennials. It is still an anxiety-producing process in many ways, so if we had to call out the things we would encourage you not to worry about, what would they be?

Budget

There are a lot of convoluted ways to arrive at a housing budget, and most of them would send any normal person screaming from the room. But there is a very simple room of thumb that is a great starting point for what you can afford whether you have student loans or not: take your total household income, and multiply it by three. That is a pretty good baseline for what you can afford and may even be conservative if your student loans are almost or completely paid off. This will help get you thinking about areas of town you want to target and what you can reasonably afford in those areas. You can gather all this information without having to contact a mortgage broker before you are ready.

Vacations and high-end eateries

This one burns. If you have decided that you are pretty committed to buying a home in the near future, one of the best things you can do to pad yourself with a good down payment and save for moving costs and renovations is to trim a couple consumer costs that millennials love so much: vacations and higher end eating out. Previous generations were far more likely than millennials to forgo vacationing and pricy experiences in order to sock away cash to buy a home, knowing that it was only temporary. In a way, though, the millennial love for these things is natural: with an adult world as crazy as the one they came into, the sure bet is to spend on relationships and memories. Hard to argue with that, but thankfully, times are changing. Your friends may tease you, but in a couple years, they’ll wish they had done the same.

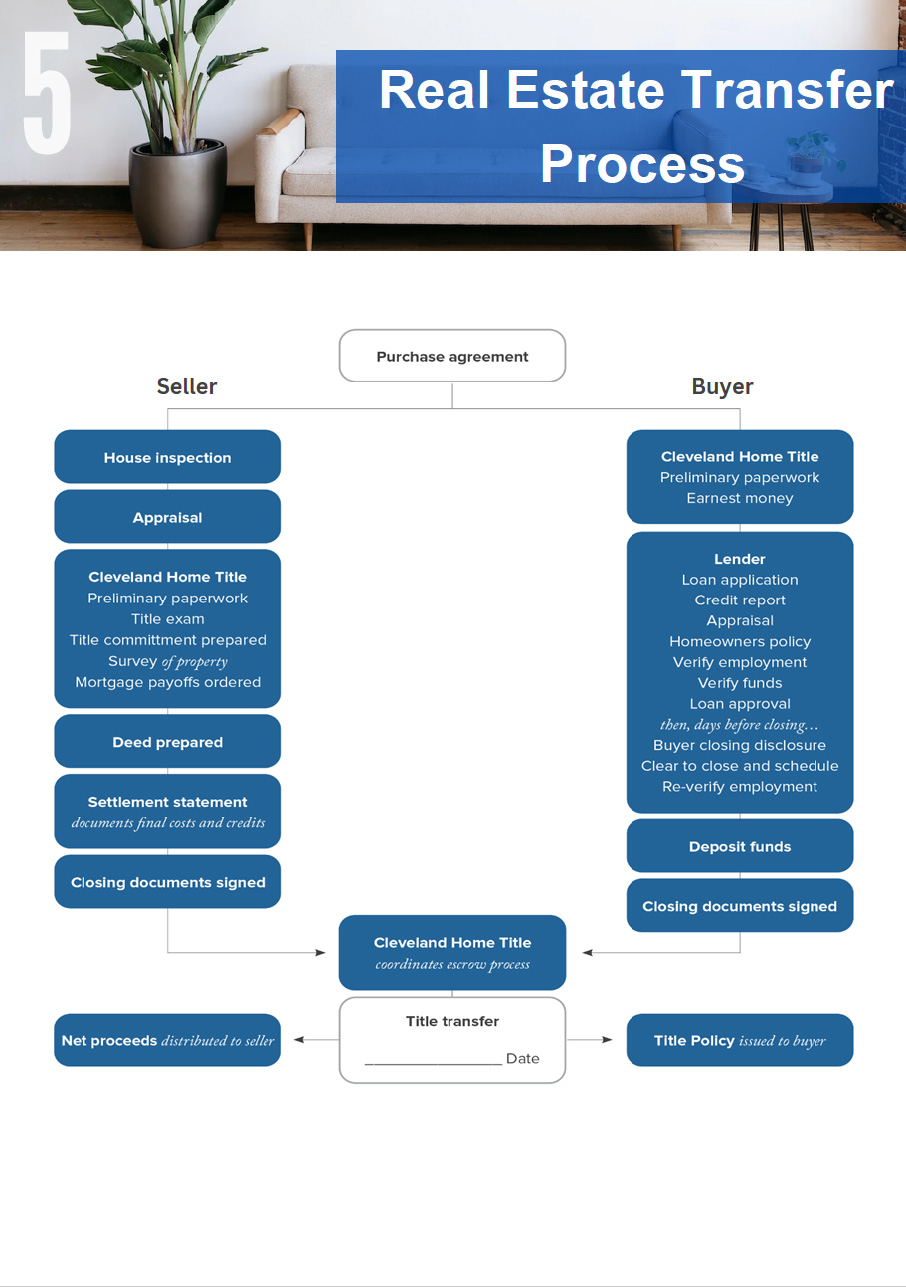

Working with a title company like Cleveland Home Title can equip you with any information you need to make your purchase successful while still keeping you in the driver’s seat. We help hundreds of self-represented homebuyers every year make their hopes a reality and do it in a way that is savvy, timely, and no-frills. We’d love to have that conversation with you.