So you are looking to purchase or have previously purchased property in Cuyahoga County, and you want a tax assessment. This isn’t the kind of thing we look forward to in buying a home or commercial property and maybe this is the first time working with the Cuyahoga County Auditor. Dealing with historical records and data, wait times on the phone, and the inevitable paper trail is a pain. But nailing down the true assessed value for your property is essential moving forward so that you are neither stuck with a bill that is unfairly high which you have to appeal or unrealistically low which could bring the Department of Taxation knocking later.

How do you navigate the process in Cuyahoga County and come away with the tax assessment you need? Below are three important FAQ’s that you may be asking when working with the Cuyahoga County Auditor:

When is a good time to get a tax assessment?

Obviously, before the close of a sale on a property is an essential time to get a tax assessment. A fresh assessment will identify aspects of the home or building’s cosmetic and functional makeup that will add to the taxable value or detract from it. For example, if you are purchasing a commercial property that has been cosmetically updated but you know that the utilities and certain structural components are in poor repair, the Cuyahoga County auditor will help you avoid overpaying in taxes when, at first blush, the assessed value may have ended up being more.

Why should I challenge an assessment?

If you believe you are overpaying in taxes on the assessed value of your property, although the process is inconvenient, there are a few advantages:

- You may be eligible for reimbursement of taxes you paid at too high a rate

- You will save on taxes you would have paid otherwise for years to come

- While not the same, your assessed value is related to your fair market value, and having a current fair market value is valuable, especially when going to sell

What extra information should I have on hand?

Having the information you will be required to submit beforehand will go a long way in easing the hassle of the process. The Cuyahoga County auditor gets a bad rap for not being adequately responsive, long wait times on the phone, and online resources that are very limited. The truth is, as the Cleveland area has roared back over the years from the Recession and hit a stride in real estate transactions, the auditor has been in the hot seat to keep up. That said, here is what you need:

- The most recent fair market value you have. In the state of Ohio, the assessed value is 35% of the fair market and appraised value, and this percentage is the value that is taxed. This will give you a barometer for how close the assessed value is to being on target.

- Do you have documentation that you are over the age of 65 or are disabled? You may be eligible for Ohio’s Homestead Exemption depending on your income.

- Your home type. As “tiny houses” and other more unconventional types of dwellings continue in vogue, your taxes could reflect the home type and should be more affordable.

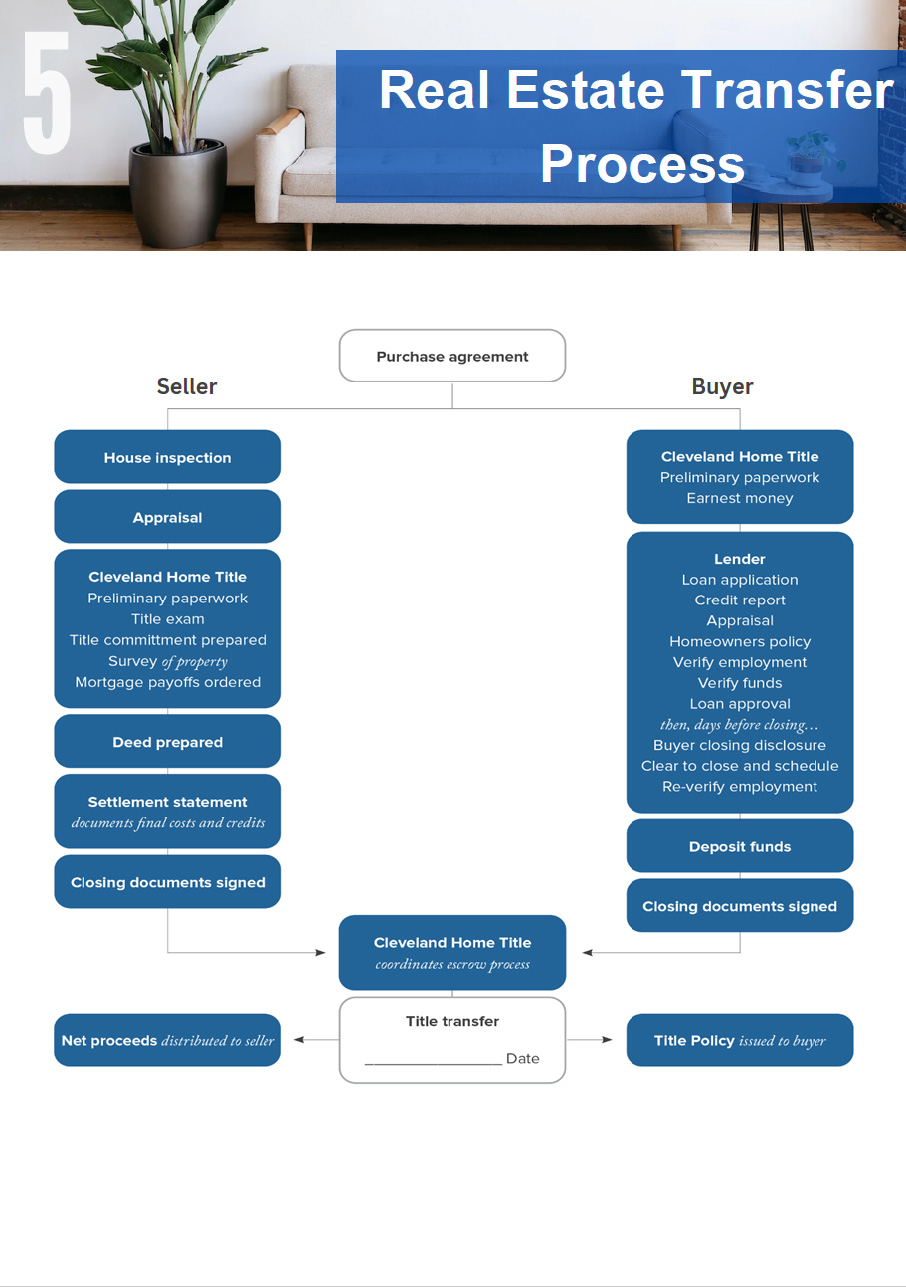

While going through the process of obtaining a property tax assessment is bothersome, it is worth it. On the other side of a property tax assessment, you will have greater clarity (and hopefully more money in your pocket!) moving forward as you look to buy, sell, and invest. Still a little daunted? That is why Cleveland Home Title is here. We are experts at navigating the entire process of title obtainment, including the tax implications, and can advise you in your journey toward completion.

With a staunch belief in the Cleveland area and Cuyahoga County as a wonderful place to live and do business, we at Cleveland Home Title are proud to do what we do.